E&R for The Souled Store |

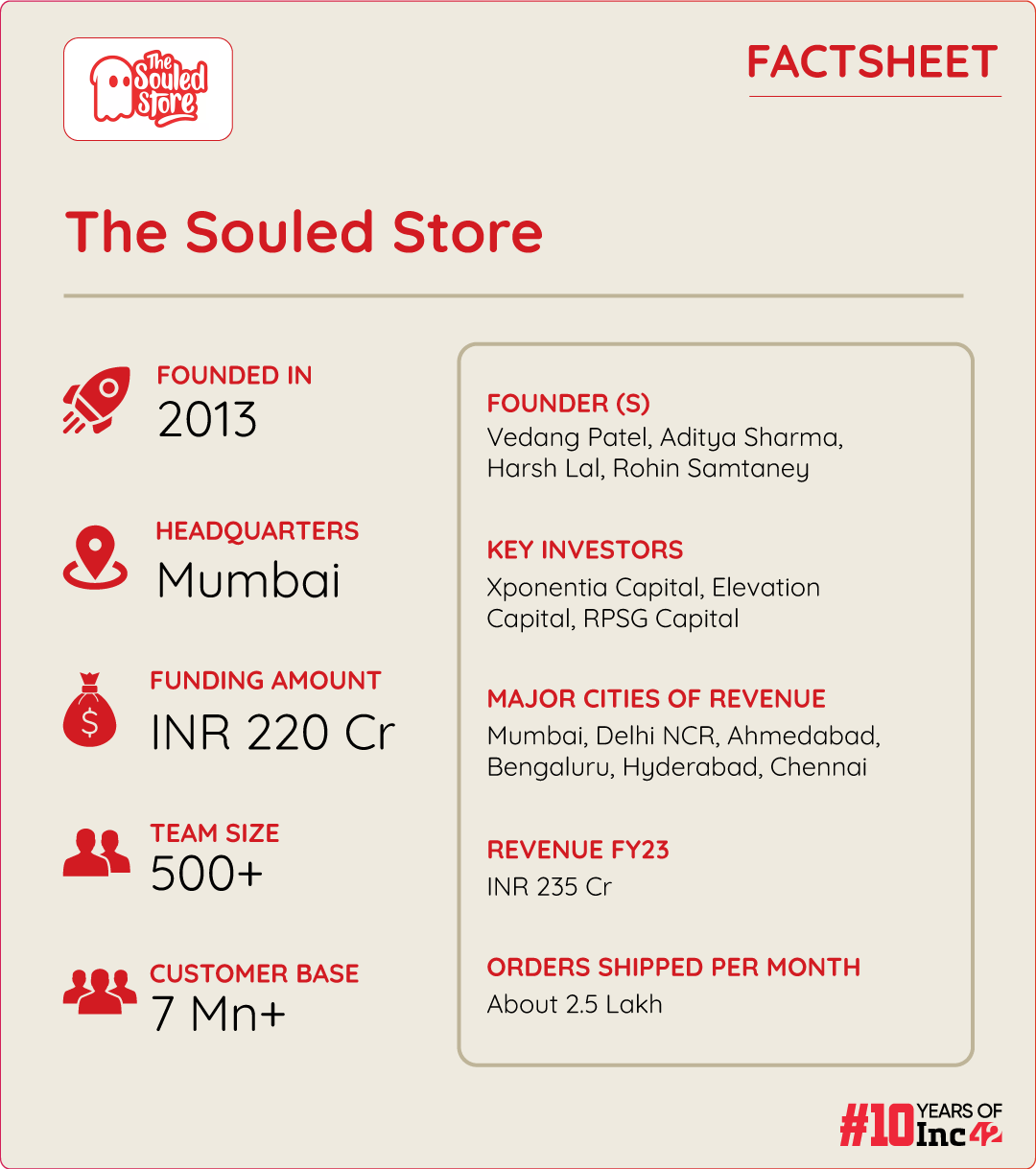

TSS started in 2013, when 4 friends came together to sell pop-cultured inspired clothing to direct to consumer starved of their desired to purchase official merchandise. The founders left the world of finance and channeled their inner nerds and went on to create India's largest pop-culture website serving more than 6 million happy customers till date!

The souled store is an omnichannel Direct-to-consumer fashion apparel brand. It has 22 offline retail stores across India and are available across marketplaces like Myntra, Flipkart and Amazon.

The brand has a large collection of pop-culture apparel and accessories on its platform including the likes of MARVEL, DC, Friends, The Big Bang Theory and countless others.

TSS is meticulous in providing a superior customer experience and true to fan culture runs quirky marketing campaigns like recreating popular TV show songs, organizing movie watch parties and posting about recent trends in their channels.

👑CVP of TSS: the "soul" of the store?

The core value propositions of the TSS to provide fans an opportunity to display their fandom by purchasing and flaunting official licensed apparel and accessories of popular media at an attractive price. The value is provided in the form of: -

- Officially Licensed Merchandise from popular franchises across comics, cinematic universe, cartoons TV-shows and sports for customers looking to express their style and fandom. The emphasis on pop-culture is well presented by the app landing screen that clearly sets the expectations of the users.

- Comfortable, trendy and quirky casual apparel that prioritizes comfort, quality & durability.

- Wide category of products including clothes, backpacks, sneakers, caps, perfumes and even pet merchandise!

- Simple and aesthetically shopping experience with well-designed application and web platform, that creates an engaging shopping experience, excitable product discovery and seamless checkout and payment experience.

🔁How does the user experience the CVP repeatedly?

By successfully making repeat purchases on the platform across a wide range of fashion categories while earning big discounts, free delivery, early access and priority shipping as a part of the membership plan.

⏱️Natural Frequency of the CVP

The core proposition of the TSS is access to pop-culture merchandise. This makes the TG limited to mostly between the 18–30-year-old age bracket. While in today the purchasing pattern has changed and user has switched buying clothes on occasions to buying apparel and accessories round the year. Yet the core product of the TSS has very specific consumer segment. To mitigate this and increase the customer frequency, the brand is also introducing new categories and designs to diversify.

For now, the natural frequency can be defined as:

- Causal user: Purchasing official merchandise at least once in a year

- Core user: Purchasing official merchandise and TSS original casual fashion items at least twice in a year

- Power user: Purchasing multiple times a year across official merchandise, casual apparel, accessories while being a member

While TSS doesn't have any other sub-feature per se. The diversified categories across apparel and clothing can be considered as sub-products and experienced best through the frequency of purchase.

💍Engagement Framework

Engagement | Key Tracking Metric | Selected | Rationale |

|---|---|---|---|

Frequency |

| Yes |

|

Depth |

| Yes |

|

Breadth |

| Yes |

|

The ideal engagement framework for TSS is based on the following

- Breadth of offering:

- Wide selection of official merchandise. More the user purchases more delight based on personalized delivery, product quality and ease of purchase.

- As users try more products, they gain TSS points which can be used for shopping on the platform.

- Depth is also a framework to consider because:

- Active users can be cross sold multiple categories increasing delight

- As user spend more time on the product page, their discovery increases, increasing value of engagement.

🏃Active users

The active users on the TSS have thee following attributes:

- Minimum 1 purchase in 6 months.

- Minimum 2 site visits / app sessions in 6 months.

- Minimum 1 item in Wishlist in 6 months.

- Purchased membership at least once in a year.

➗Segmentation of users

| Casual | Core | Power |

|---|---|---|---|

Natural Frequency | 1 | 4 | 8 |

AOV | ₹ 1500 | ₹ 2000 | ₹ 2500 |

ARPU | ₹ 1500 | ₹ 8000 | ₹ 20000 |

Engagement with |

|

|

|

Top categories | Casual wear, Official merchandise | Casual wear, | Casual wear, |

Average Session | 10 mins | 20 * 4 = 80 mins | 20 * 30 = 600 mins |

Platform loyalty | Low | Moderate | High |

Advanced segmentation | Hibernating | Promising | Champion |

👥Persona based user segmentation

| ICP-1 | ICP-2 | ICP-3 | ICP-4 |

|---|---|---|---|---|

Name | Yash | Ananya | Deep | Priya |

Age | 16-24 | 16-24 | 25-32 | 24 - 32 |

User category | Core | Core | Power | Casual |

Gender | Male | Female | Male | Female |

City | Metro, Tier-1, Tier-2 | Metro, Tier-1, Tier-2 | Metro, Tier-1 | Metro, Tier-1 |

Marital Status | Single | Single | Single / Married | Single / Married |

Kids | None | None | 0 /1 /2 | 0/1/2 |

Occupation | Student | Student | Working | Working |

Industry | Freelancing, internships, | Freelance, internships, | Startup, MNC, Pvt. sector | Startup, MNC, Pvt. Sector |

Annual Earnings | < 3 Lakhs | < 3 Lakhs | 12 - 30 Lakhs | 12 -30 Lakhs |

Time Spent | Acads, hanging out with friends, | Acads, hanging out with friends, | Working, sports, work out, | Working, sports, work out, |

Money Spent | Rent & utilities, commute, | Rent & utilities, commute, | Rent & utilities, commute, | Rent & utilities, commute, |

Tech Savviness | High | High | Mid to high | Mid to high |

Most used apps | Netflix, Prime videos, hotstar | Netflix, Prime videos, hotstar | Netflix, Prime videos, hotstar | Netflix, Prime videos, hotstar |

Content preference | OTT shows IG reels, sporting | OTT shows IG reels, sporting | OTT shows IG reels, sporting | OTT shows IG reels, sporting |

Purchase pattern | frequent but low ticket | frequent but low ticket | frequent & high ticket | frequent & high ticket |

Purchase preference | Online | Online | online & offline | online & offline |

TSS user | Yes | yes | Yes | yes |

What brings you to | Quirky designs, official merchandise, | Quirky designs, official merchandise, | Casual wear, official merchandise, | Casual wear, official merchandise, |

What do you dislike | Quality of the item | | ||

What do you shop | T-shirts, Joggers, sweatshirts, | Coord sets, T-shirts, Joggers, | T-shirts, Joggers, sweatshirts, | Coord sets, T-shirts, Joggers, |

Years used | 3 - 5 years | 3 - 5 years | 3 - 5 years | 3 - 5 years |

Purchasing for | Self | Self | Self, gifting, kids | Self, gifting, kids |

AOV / year | INR 4000 | INR 4000 | INR 15000 | INR 12000 |

Yearly clothes | 15 k -20 k | 15 k - 20 k | 20k - 30k | 20k -30k |

Other platforms | Ajio, Myntra, Zudio., Nobero, | Ajio, Myntra, Zudio, Bewakoof, Jisora, | Bewakoof, Redwolf, Wyo, | Ajio, Myntra, Zudio, Bewakoof, |

What do you look | Designs, comfort, fit, availability | Designs, comfort, fit, exclusivity | Design, comfort, fit, Authenticity, | Design, comfort, fit, Authenticity, |

NPS | 9 | 9 | 7 | 7 |

pain points with TSS | Material, Design might be limited, | Fit is the main issue, lack of options | Limited design appeal, Lack of | Fit, lack of age appropriate |

User segment | Promising | Promising | Potential Loyalist | Potential Loyalist |

👀Insights from user interview

- Quirky designs - The strongest recall amongst majority of the consumers of TSS is its unmissable design language. The design has been termed as quirky, which also hazards it to be labelled and pigeonholed. The brand is however trying to expand its offerings by expanding their design language into pastels in casual wear.

- Marketing efforts - Several younger demographics have pointed out the effectiveness of their social media campaigns. TSS runs effective social media campaigns involving influencers and collaborators for UGC around product review, GRWM and styling videos. Furthermore, TSS hosts fun events and take up CSR activities and promote them on theri SM handles to improve visibility. Lately they have been able to rope in celebrity endorsements of the like of Sara Aali Khan & Hardik Pandya, which has also increased their reach.

- Neglect of women TG - Several women TG felt neglected by TSS. Complaints ranged from issues with fit, lack of gender fluid options to outdated merchandise collections for women. While one user also iterated that TSS were one of the earliest to bring out t-shirt dresses & shirt dresses, they seem to have not strengthened the category. A survey of the TSS website reveals new summer collections for women along with denims, coords and other categories. The brand needs to communicate the availability of range to its women TG in a more effective manner.

Not so much right now. Earlier I liked them for their merchandise, especially for T-shirts with lyrics / art from my favorite bands. They have nothing good on that front now and are not as creative as they used to be 5-7 years ago

📢Engagement Campaigns

The following data from similarweb points to the quarterly site visits and the split across devices for TSS.

Campaign | Campaign-1 | |

|---|---|---|

Goal of the campaign | Increase engagement and drive repeat purchases among casual and core users | |

User segmentation | Casual and core | |

Pitch /Content | Hello there! refreshing summer styles! | |

Offer | 15% off on purchases above INR 2000 | |

Channel | Email, WhatsApp, App Notification | |

Frequency | Twice a month | |

Time | Morning (9 AM - 11 AM) | |

Rationale | Casual and core users are more likely to engage with new collections and are motivated by discounts | |

Success metric | Increase in website/app visits, number of purchases, and average order value |

🕸️Retention

1️⃣Understanding the Retention

Here is a video of Vedang Patel, founder of TSS talking about retention with a popular podcaster and social media influencer.

The customer retention rate for DTC apparel brands is approximately 28% - (Source)

Based on the secondary research, the retention curve for TSS should start flatteing around year 2 of customer lifetime.

ICPs driving best retention -

Based on the data available on similar web, the following ICPs are driving the retention-

- The core and power users are driving the most retention - Both ICP-1 &3 is driving retention as shown by the site visit and the demographic data. They have the most offering on the platform

- ICP 2& 4 are also part of the retention cohort as per the data.

Channels driving best retention -

As can be seen from the similarweb data the paid ads and organic content loop channels are driving the most retention for TSS.

Sub-feature /Sub-product driving retention

The sub-products / features driving most retention are:

- Diverse collection of casual clothing

- New categories like sneakers

- New product categories like apparel of Supina Cotton

- New accessories like backpack and caps.

- Membership and loyalty programs.

2️⃣Churn

The online fashion commerce industry has typically low loyalty. The crowded fashion ecommerce marketplace is extremely crowded. Not to mention offline disruptors like Zudio which sways bargain-hunters and customer segments with low brand loyalty.

TSS takes and omni-channel approach, and 64 % of its revenue comes from its website and mobile apps, followed by offline stores (21%) and marketplaces (15%). - (source)

Considering its main source of revenue there can be several reasons behind user churn, notably -

Voluntary Churn | Involuntary Churn |

|---|---|

Issue with quality of the product | Unresponsive or delayed customer support |

Limited collection of official merchandise | Delivery, exchange and return related issues |

Limited range of categories of the product | Inability to save card details on the platform |

Facing issues with the fit | Lack of payment options |

Limited stock and availability of bestselling products | Lack of discounts & offers |

Perception of high prices relative to the value | Membership plan of limited use or value |

Slow or unhelpful customer support | Repeated payment issues |

Entrant of a competitor / new brand | Evolving taste, outgrowing brand designs |

Better offers and discounts from other platforms | |

Concerns about fake products on the platform | |

⛔Negative actions indicative of churn

- The user no longer values the product offerings and are no longer actively engaging or visiting the website or the app resulting in reduction in number of visits to website / apps.

- Frequently adds items to the cart but not checkout resulting in abandoned carts. Can point to dissatisfaction with payment or lack of payment offers.

- Posting negative reviews & feedback on public forums like reddit, Facebook & X.

- High rates of return indicating dissatisfaction with product quality or fit.

- Rise in number of customer tickets which in turn drives negative ratings and WOM.

- Surrender or reduced usage of membership pointing to reduction in value to the customer and lower repeatability.

- Decreased purchase frequency or reduced AOV.

- Reduced usage of Wishlist feature. No longer adding item to Wishlist pointing to lack of interest in the product

3️⃣Resurrection Campaign

Campaign # | Campaign-1 | Campaign-2 | Campaign-3 | Campaign-4 | Campaign-5 |

|---|---|---|---|---|---|

⚽Campaign Goals | To increase | To increase membership number | To decrease cart abandonment | To announce faster shipping & | To increase engagement |

🅰️Campaign Name | "Avengers reassemble" | "Join the fellowship" | "Save your cart" | "Faster than the flash" | "Explore the multiverse" |

👤User Segment | Hibernating | Promising | Price sensitive / Value conscious | Lost | Potential Loyalist |

💌Pitch/ Content | Calling earth's mightiest heroes!

| An adventure awaits you! Join the fellowship today and get | Help! you cart is needs saving! | We have a new superpower! Now enjoy next-day shipping | Welcome hero! The multi-verse Now unlock the world of |

💵Offer | 25 % discount | 10% discount on membership plan | 20 % discount coupon | 10% on select merchandise | free shipping |

📆Frequency | once | once | once | once | once every week for 2 weeks |

🕒Timing | 8 months after last purchase | Within 2 days of repeat purchase | within 2 hours of cart abandonment | no purchase after 6 months of | after 2 purchases in 2 months |

📺Channel | Email notification, WhatsApp | Email, In-app pop-up | WhatsApp notification, mobile push | Email notification, WhatsApp | WhatsApp notification, email, |

❓Rationale | This campaign is looking to nudge | To onboard potential loyalists as | To offer one time discount to price | To reconvert users who had | To increase the engagement across |

🎊Success metric | Conversion rate. | Membership enrollment | Discount applied | Site / App visit, App installation, Items Wishlist, | Items Wish listed, |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.